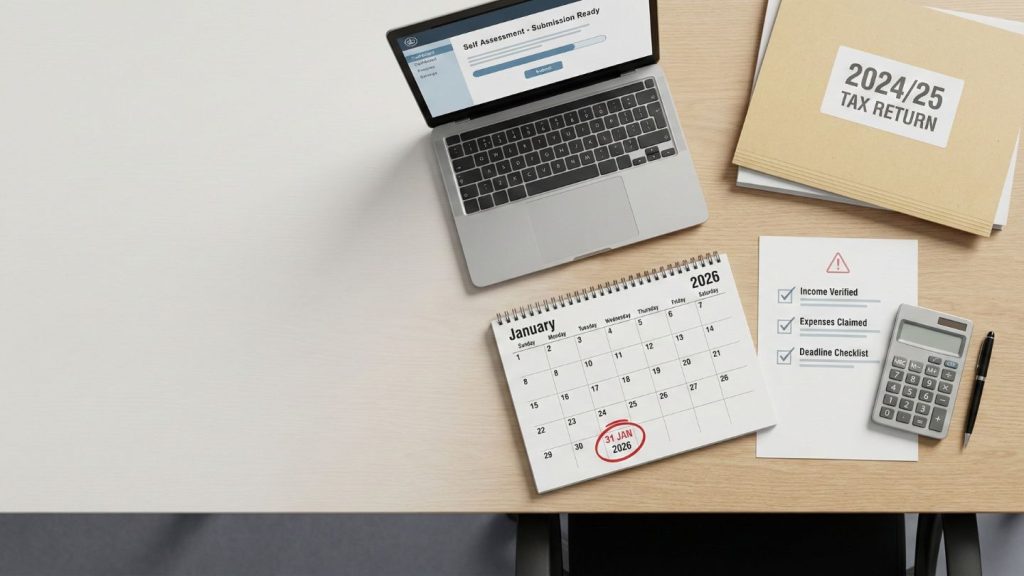

With the 2026 New Year celebrations behind us, the reality of the 31 January Self Assessment deadline is setting in. If you are reading this, you likely still need to file your return for the 2024/25 tax year.

Do not delay. This year, the cost of burying your head in the sand is higher than ever due to increased interest rates on late payments.

Here is the essential breakdown of dates, fines, and how to avoid them.

The Only Date That Matters: 31 January 2026

For online returns, you must file and pay any tax owed by 11:59 PM on 31 January 2026.

- Filing Deadline: If you miss this, you incur an instant fixed penalty.

- Payment Deadline: If you miss this, interest begins accruing immediately.

Pro Tip: Do not wait until 10 PM on the 31st. HMRC’s online services frequently slow down under the weight of a million users trying to file simultaneously.

The “Hidden” Cost: Late Payment Interest

Many taxpayers focus on the fines but ignore the interest. This is a mistake.

HMRC’s late payment interest rate is currently tied to the Bank of England Base Rate plus 2.5%. With rates remaining high in 2026, if you owe tax and ignore it, you are accruing significant daily interest that offers zero value to you.

The Penalty Timeline: What Happens If You Miss It?

HMRC’s penalty regime is automated and strict. There is no “grace period” for being busy.

- 1 February 2026 (1 Day Late): £100 Fixed Penalty. You are charged this immediately, even if you owe no tax or have already paid the tax but simply forgot to file the form.

- 1 May 2026 (3 Months Late): Daily Fines begin. You will be charged £10 per day, for up to 90 days (maximum £900). This is where the costs spiral out of control for disorganised taxpayers.

- 1 August 2026 (6 Months Late): 5% of tax due (or £300, whichever is greater).

- 1 February 2027 (12 Months Late): Another 5% (or £300) charge.

Why “DIY” Filing is Risky in January

Rushing a return in late January is the leading cause of simple errors—miscalculating expenses, ticking the wrong box for High Income Child Benefit Charge, or forgetting to declare savings interest.

HMRC’s AI-driven “Connect” system now automatically cross-references your return with bank and platform data. A rushed mistake now can trigger an enquiry letter in six months.

The Solution: Fast, Accurate Filing with Protax Consultants

You still have time to hand this off to a professional.

At Protax Consultants, we specialise in emergency January filings. We don’t just “fill in the boxes”; we review your figures to ensure you aren’t overpaying tax or triggering audit flags.

- Speed: We can turn around urgent returns quickly.

- Accuracy: We ensure you claim every relief available to you.

- Peace of Mind: You get a confirmation email, not a penalty notice.

Frequently Asked Questions (FAQ)

Q: Can I appeal the £100 fine if I have a reasonable excuse?

A: Yes, HMRC accepts “reasonable excuses” (like a sudden hospital stay or computer failure right at the deadline), but they rarely accept “I forgot” or “I was too busy.” You must pay the fine first, then appeal.

Q: What if I can’t afford to pay my tax bill by 31 Jan?

A: File the return anyway. Always file on time to avoid the £100 fine. Then, set up a “Time to Pay” arrangement with HMRC online to spread the tax bill over monthly instalments.

Q: Do I need to file if I earned less than £1,000?

A: Generally, no. The “Trading Allowance” covers the first £1,000 of self-employed income. However, if you are already registered for Self Assessment, you should contact HMRC to ask them to close your record, or file a “Nil Return” to close the loop.